Nostro’s monetization engine runs on a strategic 50/50 issuance model. Half of all newly issued N-Coins go to the market through auctions and strategic allocations. The other half is retained by the company.

Company-held coins are fully visible on-chain and never sold below their €1 face value. Instead, they are rented out as transaction liquidity. This fuels real business activity and generates recurring, zero-risk revenue. N-Coin’s value is driven by ecosystem demand and real-world utility. It functions as a yield-bearing digital asset that is fully backed, regulated, and built to scale.

As usage increases, demand and market price rise. When the price moves too far above the peg, Nostro releases coins to stabilize the market and keep access affordable for businesses. This ensures sustainable coin value, reliable liquidity, and long-term system health.

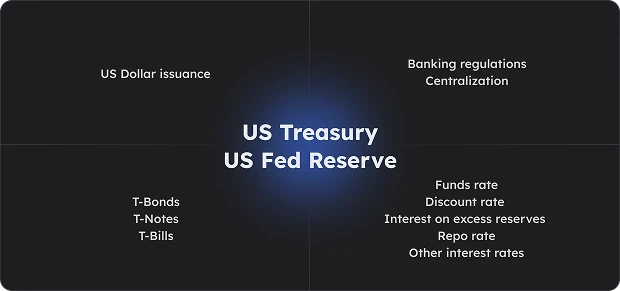

This isn’t inflation. It’s monetary policy inspired by the U.S. Fed and Treasury — and it scales.