- Because this round decides who controls a multi-billion-dollar financial rail.

- Because based on already signed institutional demand, this model reaches full-scale economics within 3–4 years.

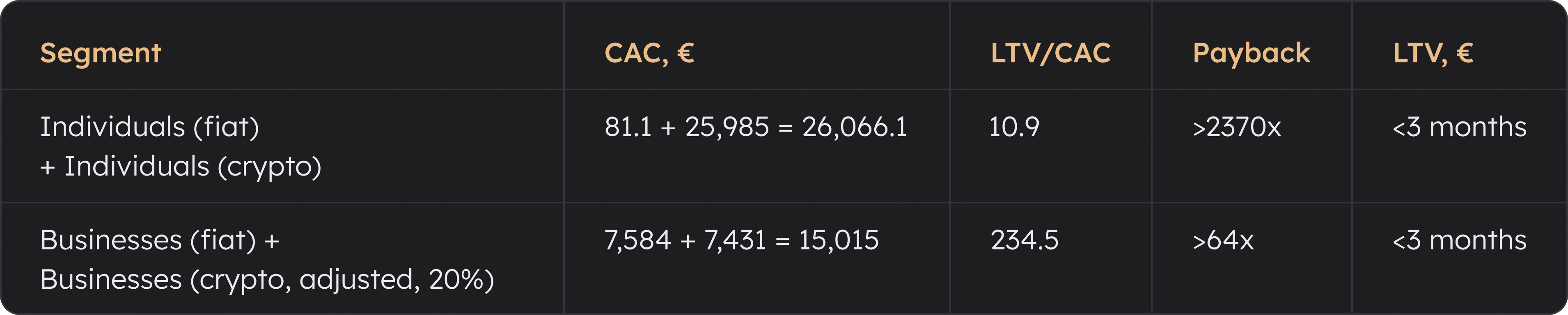

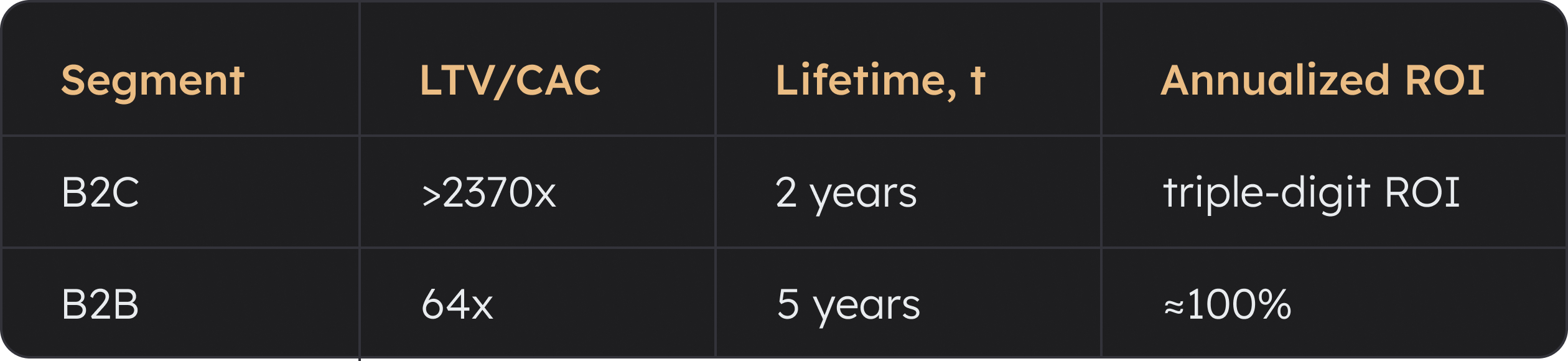

- Because verified LTV/CAC models show €5M scaling to €3.5B, with business LTV of €7,584 (fiat) + €7,431 (crypto) at CAC €234.50. Full model is in the Data Room.

- Because $5M for 5% puts us at $100M post money today and our growth model projects unicorn range in the next raise.

- Because the $3.5T market anomaly is ripe and no one else is harvesting.

- Because only 0.0045% of all businesses accept crypto while the market cap exceeds $3.5T creating a pressure gap ready for a phase shift.

We’re not raising for a prototype. We’re launching a licensed system in the EU (LT-based), with remote onboarding for clients across the UK, US, and CA.

€5M covers development, licensing, legal, key hires, and go-to-market. Every cent builds structure, locks compliance, and captures institutional flow. This isn’t capital. It’s control over the fiat-n-crypto future.

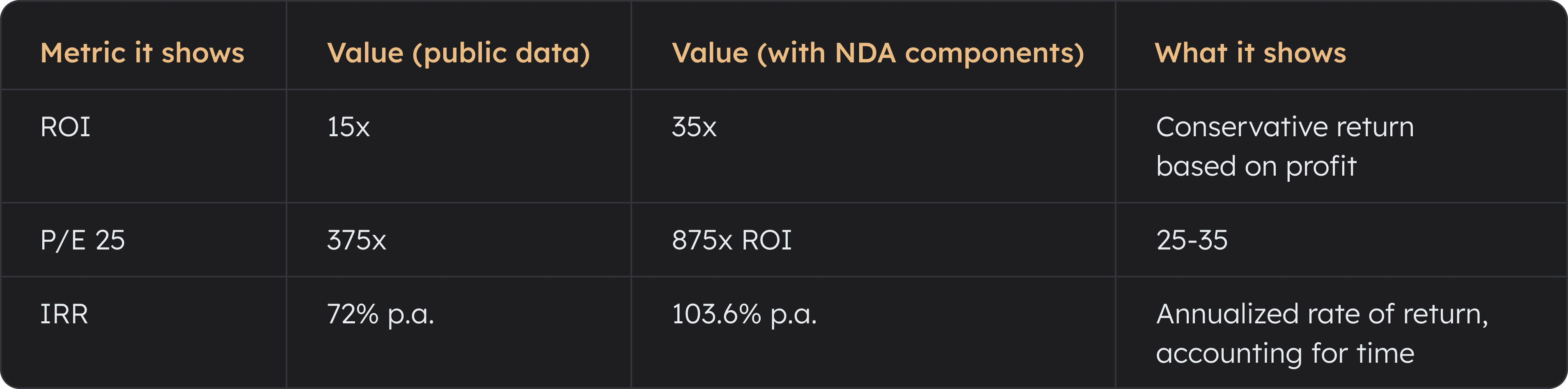

The architecture targets unicorn scale. The math is done: €5M unlocks €3.5B upside. 35x baseline. 875x modeled. We stay conservative, but we build for scale.

Pre-round is open. The move is yours.

Core system, banking logic, and compliance tech, built from scratch.

Licensing, legal, IP, and full EU compliance: bank, EMI, crypto licenses, PCI DSS, etc.

Key hires and mandatory local staffing under EU regulatory requirements.

Targeted market entry, institutional onboarding, and early client acquisition.